Medicare supplements

Medicare is a Federal health insurance program for seniors (age 65 and up), for under 65 with certain disabilities, and at any age with End-Stage Renal Disease ESRD (permanent kidney failure requiring dialysis or kidney transplant).

Medicare has two parts: Part A (Hospital Benefit) and Part B (Medical Benefit). You will hear about Part C and Part D. These are different areas that you may or may not want and isn't usually appropriate for everyone. We will discuss Part C and Part D further below and why or why not you should sign up.

Medicare 2024 Premiums

- The Part A premium is $0 for most people because they paid Medicare taxes long enough while working - generally at least 10 years). This is sometimes called "premium-free Part A."

- If you don't qualify for a premium-free Part A, you might be able to buy it. In 2024, the premium is either $278 or $506 each month ($278 or $506 each month in 2024), depending on how long you or your spouse worked and paid Medicare taxes.

MEDICARE DEDUCTIBLE AND COINSURANCE AMOUNTS FOR 2024

For each benefit period Medicare pays all covered costs except the Medicare Part A deductible ($1,632) during the first 60 days and coinsurance amounts for hospital stays that last beyond 60 days and no more than 150 days.

For each benefit period* in 2024 you pay:

- A total of $1,632 for a hospital stay of 1-60 days.

- $408 per day for days 61-90 of a hospital stay.

- $816 per day for days 91-150 of a hospital stay (Lifetime Reserve Days).

- All costs for each day beyond 150 days

*A new benefit period begins when you have been out of the hospital for 60 or more consecutive days.

Skilled Nursing Facility Coinsurance

- $204.00 per day for days 21 through 100 each benefit period.

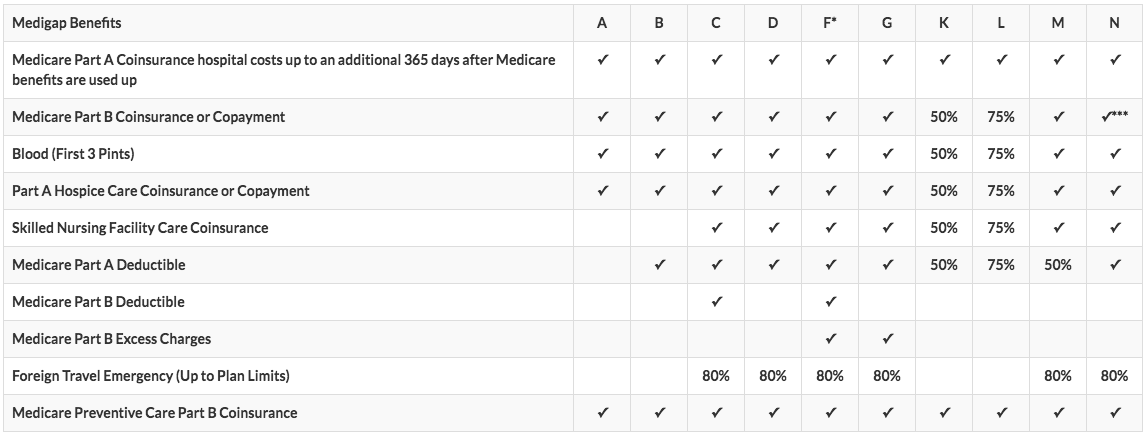

MEDICARE SUPPLEMENT COVERAGE: COMPARISON OF PLANS A-N

*Plans F and G also offer a high-deductible plan. This means you must pay for Medicare-covered costs up to the deductible amount $2,800 in 2024 before your policy pays anything.

Plan K has a $7,060 out-of-pocket limit, and Plan L has a $3,530 out-of-pocket limit. Once you meet the annual limit, the plan pays 100% of the Medicare copayments, coinsurance, and deductibles for the rest of the calendar year. These amounts can change each year.

HOW CAN I COVER THE GAPS IN MEDICARE?

You have three options

- You can pay out of pocket.

- You can buy a Medicare Supplement insurance to cover gaps left by Medicare.

- You can enroll in a Medicare Advantage Plan, Part C.

The high cost-sharing (deductibles and co-pays) of Medicare makes paying out of pocket an unreasonable option for most people. A Medicare Supplement (or Medicare Supplemental Insurance or Medigap Policy) is an insurance plan sold by a private insurance company to cover the gaps in Medicare.

Medicare Supplements are currently available in several different standardized plans. These plans are labeled A – N and cover different amounts of your cost sharing with Medicare. The premium for your Medicare Supplement will be in addition to the premium for Part B of Medicare.

All standard Medicare Supplements identified by the same letter have the same coverage regardless of the company you choose. Cost IS the only difference between standardized Medicare Supplement Insurance sold by different companies.

The chart below shows the benefits included in each plan. Every company must sell Plan A, which is the basic plan, or the “core benefit” plan. Remember, the plans are standardized. So, Plan F from one company will be the same as Plan F from another company. Select the supplement policy which fits your needs, and then purchase that plan from an industry leader with the lowest premiums and favorable A.M. Best rating.

Core Benefits:

- Included in all plans.

- Pays Part A Hospital copayment ($408 per day for 61-90 days and $816 per day for 91-150 days)

- Pays for an additional 365 days of hospitalization after Medicare benefits end.

- Pays Part B copayment (usually 20% of the Medicare-approved amount)

- Pays for the first three pints of blood per year.

KANSAS DENTAL VISION INSURANCE COVERAGE

Dental Vision coverage is not provided by Medicare or a Medicare Supplement unless it directly correlates to your health coverage. If you wish to have dental vision coverage or are just shopping for some rates, please call us today at 620-665-1490 to learn more about our dental vision coverage.